BlackRock Acquires GIP: Technology, Operational Efficiency and Productivity in Construction

What does BlackRock‘s $12B acquisition in Global Infrastructure Partners (GIP) signal about the future of the Construction Industry? Hint: technology, operational efficiency, and productivity in Construction.

About the deal:

- Blackrock is the world’s largest money manager, with $9.1T in assets.

- GIP is the world’s largest independent infrastructure manager, with $100B in assets.

- BlackRock will acquire 100% of GIP for $3B and 12M common shares, announced on 2024-01-12.

Macro Trends Driving Investment:

Booming Infrastructure Market: The infrastructure sector, valued at $1 trillion, is on an upward trajectory, fueled by digital infrastructure and decarbonization.

Government-Private Partnerships: Governments grappling with deficits turn to private collaboration to fund crucial projects.

Capital Scarcity & Higher Interest Rates: Companies seek partnerships to raise capital, making infrastructure collaboration appealing.

Micro Trends Shaping BlackRock’s Thesis:

Operational Efficiency through Technology: Technology is underutilized in Construction, and BlackRock aims to leverage it with GIP to drive operational efficiency and address productivity challenges.

Strategic Diversification: Private infrastructure investments offer stability and diversification, with steady cash flows and less correlation to traditional assets.

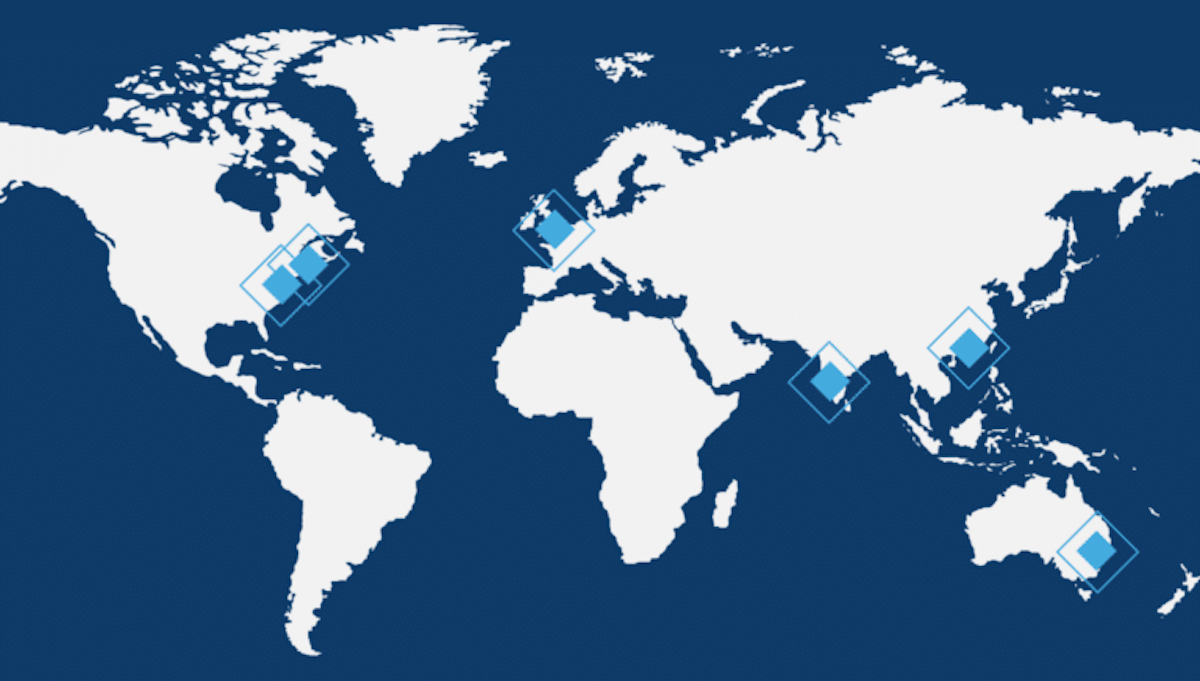

Global Collaborations: As collaborative ventures gain traction globally, BlackRock’s extensive corporate relationships facilitate critical infrastructure investments through partnering with GIP.

Technology Operational Efficiency and Productivity in Construction

As infrastructure investments surge, the collaboration between BlackRock and GIP underscores the critical role of technology and operational efficiency. Blackrock is “smart” money, and this is a big move toward a future where technology and collaborative partnerships redefine the construction landscape.

Please get in touch to learn more about how technology can improve operational efficiency and productivity in your business.